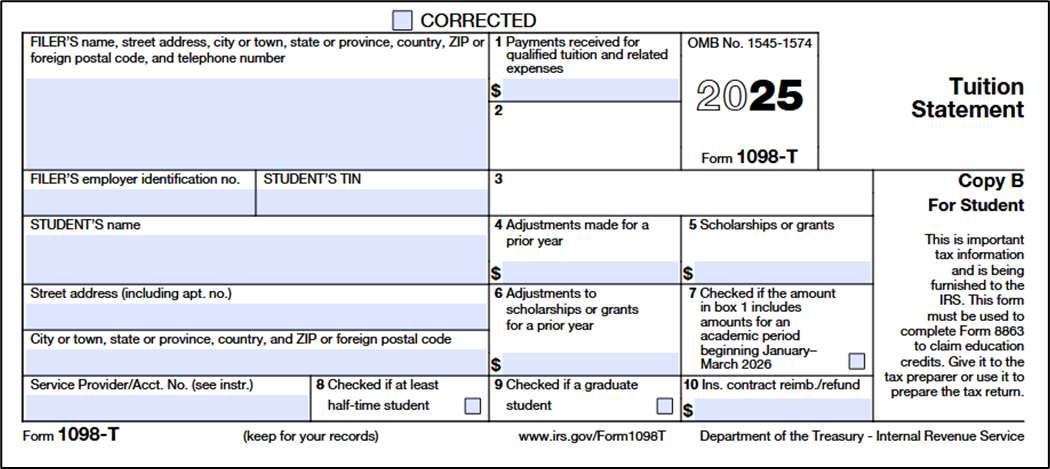

IRS 1098-T Tax Document

If your 1098-T tax document for 2025 is not viewed electronically, it will be mailed by January 31, 2026 to the home address you have listed in Access Stout. The amounts reported on your 1098-T tax document may assist you in completing IRS Form 8863 – the form used for calculating the education tax credits that a taxpayer may claim as part of your tax return. Visit the IRS site to review the Education Credit questions and answers.

The University of Wisconsin-Stout is unable to provide you with individual tax advice. If you have questions, you should seek the counsel of an informed tax preparer or adviser.

Below is a blank sample of the 2025 1098-T tax document for your general reference